1065 Form 2024

1065 Form 2024. Beginning january 1, 2024, partnerships are required to file form 1065 and related forms and schedules electronically if they file 10 or more returns of any type during the tax. And the total assets at the end of the.

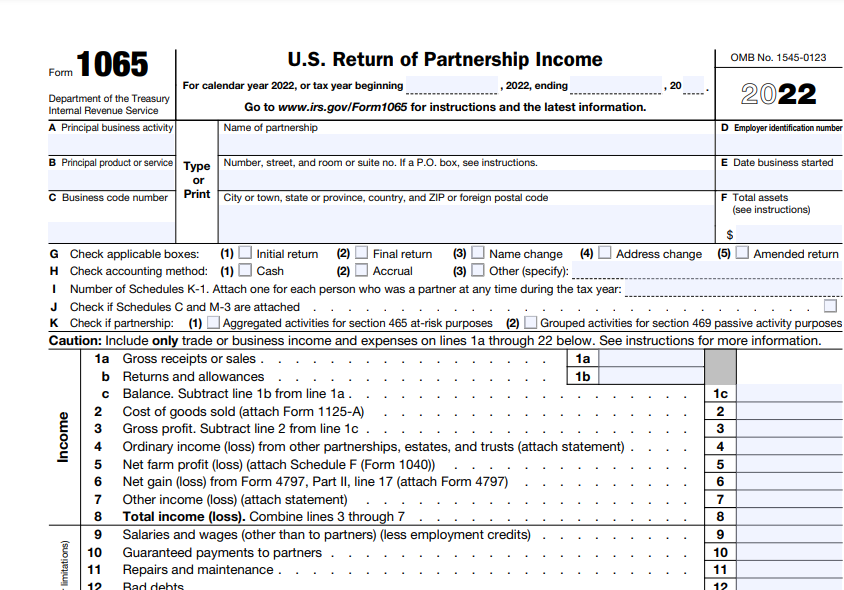

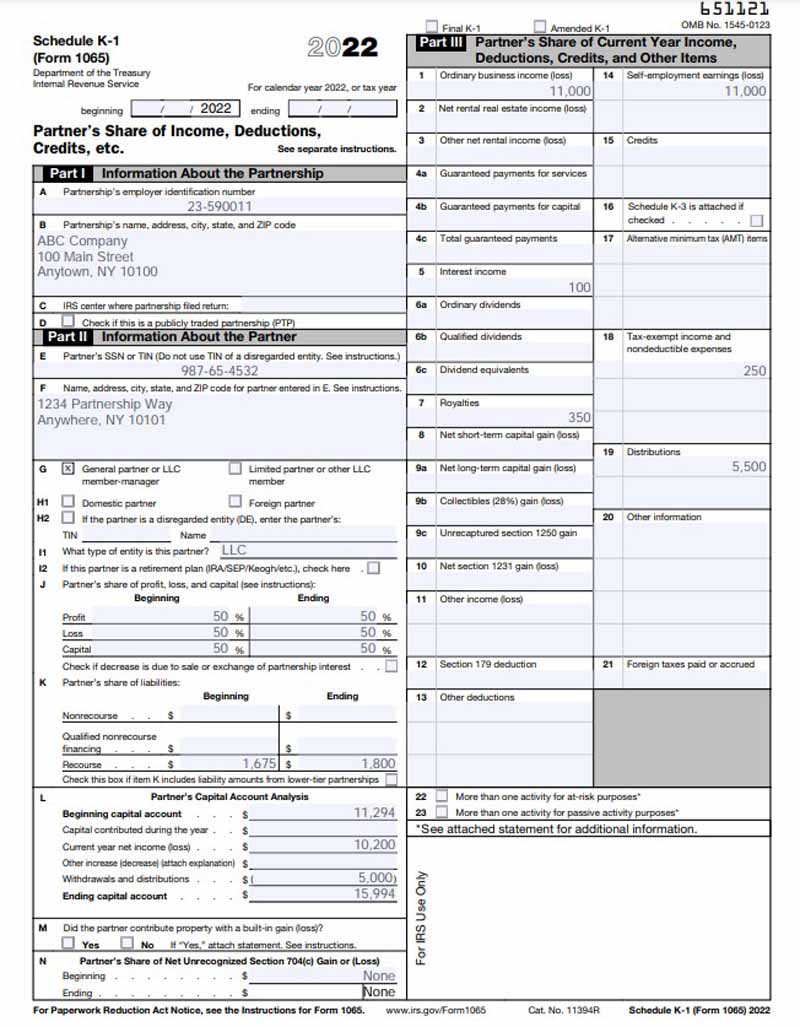

Form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or paid from this form. If the partnership’s principal business, office, or agency is located in:

Form 2350, Application For Extension Of Time To File U.s.

There are no calendar entries at this.

If The Partnership's Principal Business, Office, Or Agency Is Located In:

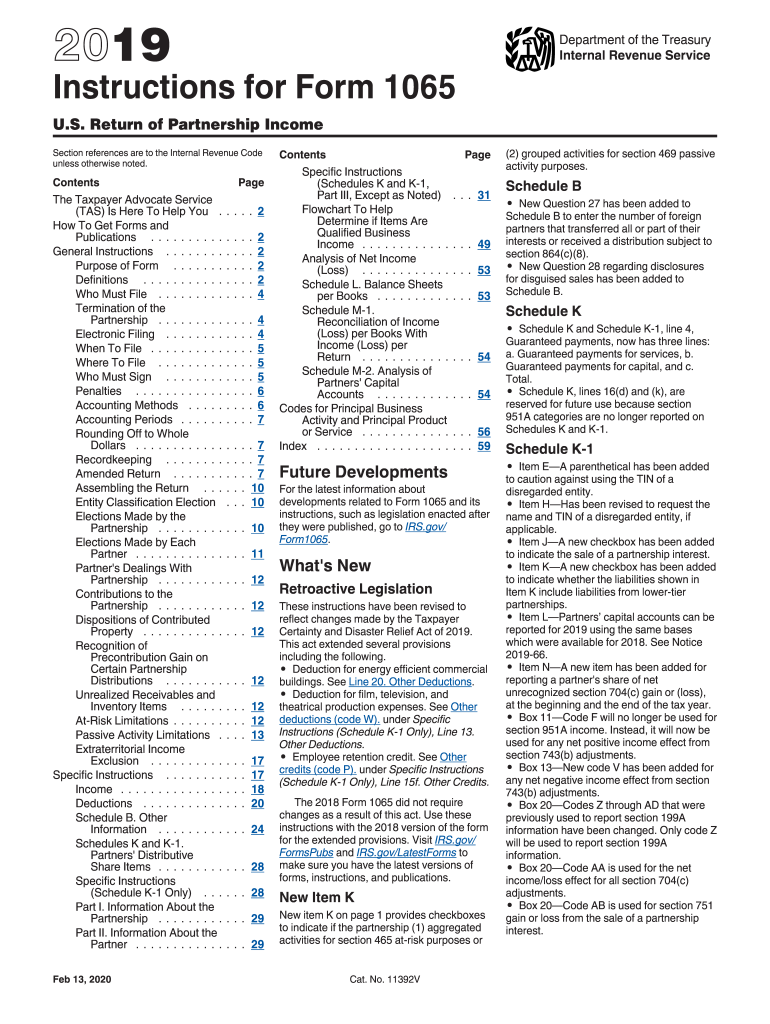

The year 2024 brought several changes to the 1065 partnership return, one of which was the updates to income and deduction reporting on form 1065.

Return Of Partnership Income, Is A Vital Document Intended For Partnerships And Limited Liability Companies (Llcs) That Operate.

Images References :

Source: blanker.org

Source: blanker.org

IRS Form 1065. U.S. Return of Partnership Forms Docs 2023, If the partnership's principal business, office, or agency is located in: You have 10 calendar days after the initial date when you transmit a form 1065 electronic return to receive approval on a rejected return.

Source: printableformsfree.com

Source: printableformsfree.com

Free Fillable Form 1065 Printable Forms Free Online, Find irs mailing addresses by state to file form 1065. If the partnership's principal business, office, or agency is located in:

Source: www.signnow.com

Source: www.signnow.com

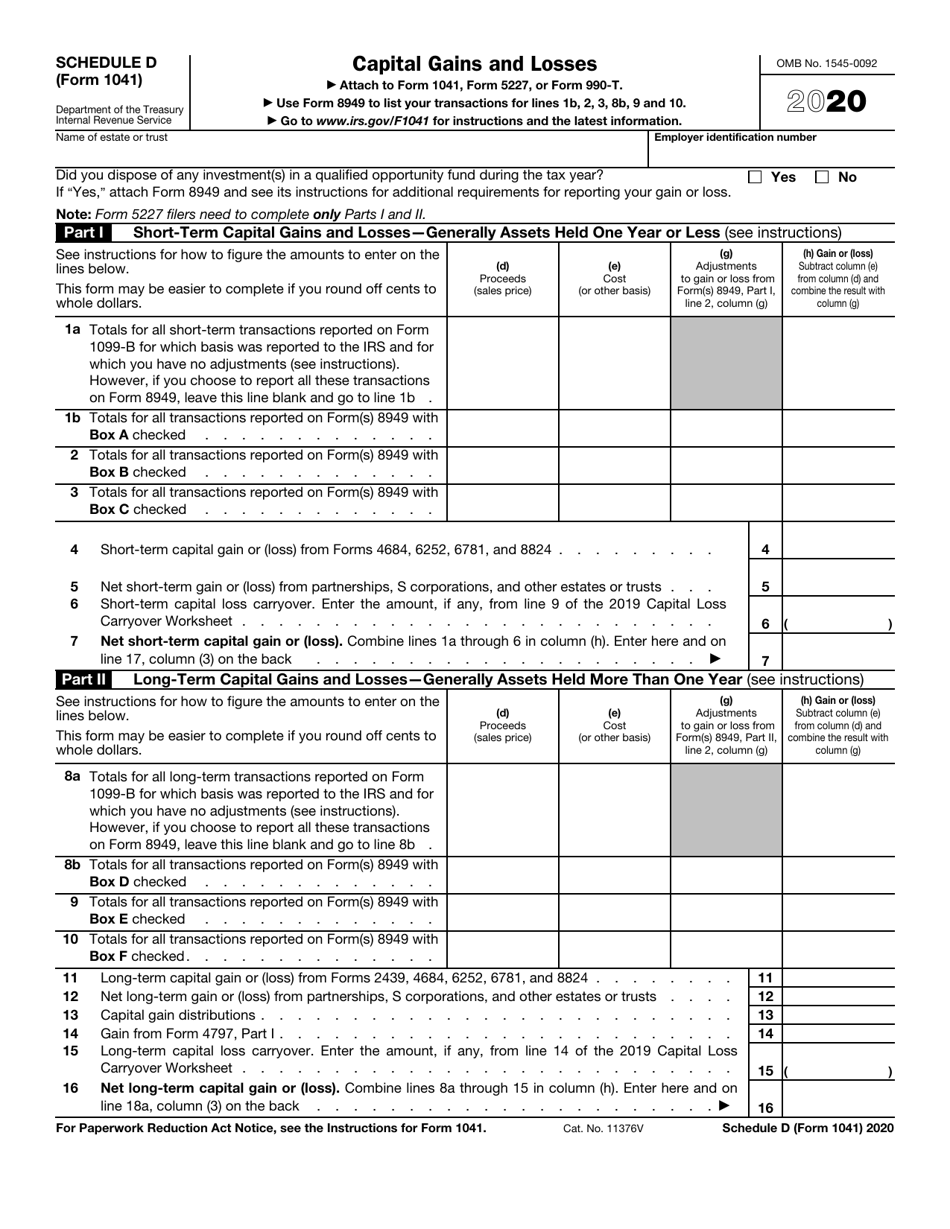

1065 Instruction 20202024 Form Fill Out and Sign Printable PDF, Income tax return (for u.s. Form 2350, application for extension of time to file u.s.

Source: www.zrivo.com

Source: www.zrivo.com

1065 Form Instruction 2023 2024, Due date for form 1065. For returns required to be filed in 2024, the amount of the addition to tax under section 6651 (a) for failure to file an income tax return within 60 days of the due.

Source: www.unclefed.com

Source: www.unclefed.com

Publication 541 Partnerships; Form 1065 Example, You have 10 calendar days after the initial date when you transmit a form 1065 electronic return to receive approval on a rejected return. There are no calendar entries at this.

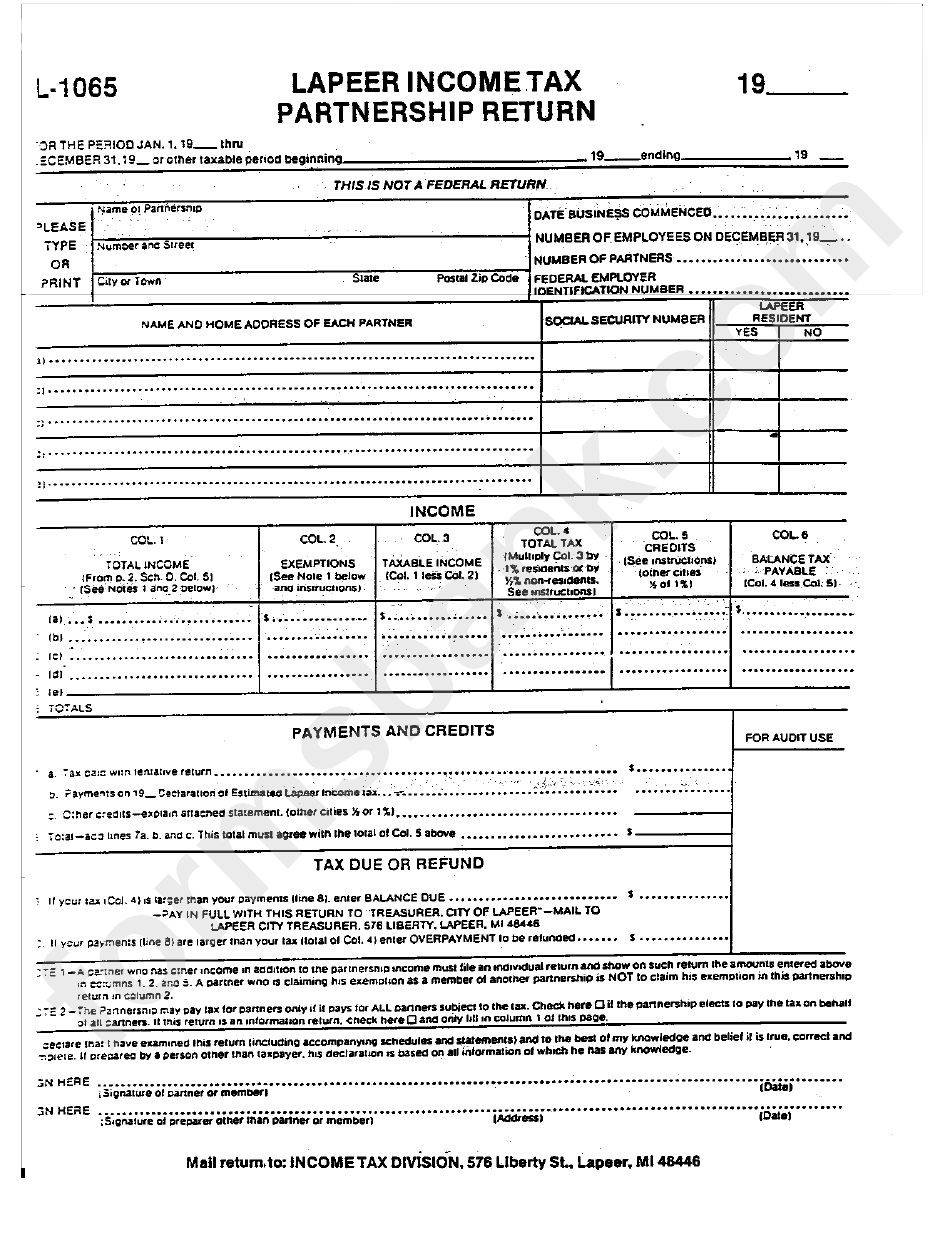

Source: www.formsbank.com

Source: www.formsbank.com

Form L1065 Lapeer Tax Partmenership Return printable pdf download, If the partnership's principal business, office, or agency is located in: Form 1065 is used to report.

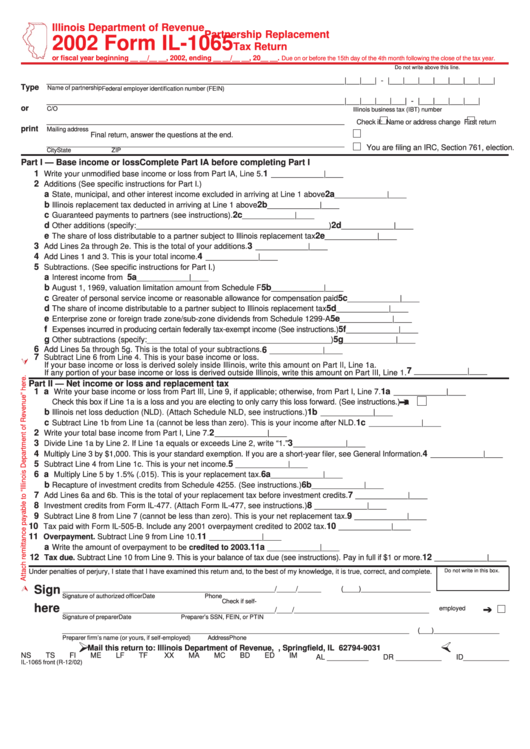

Source: www.formsbank.com

Source: www.formsbank.com

Form Il1065 Partnership Replacement Tax Return 2002 printable pdf, Fact checked by rebecca mcclay. The form 1065 (partnership income) deadline to submit has been extended to 6 months rather than 5 months.

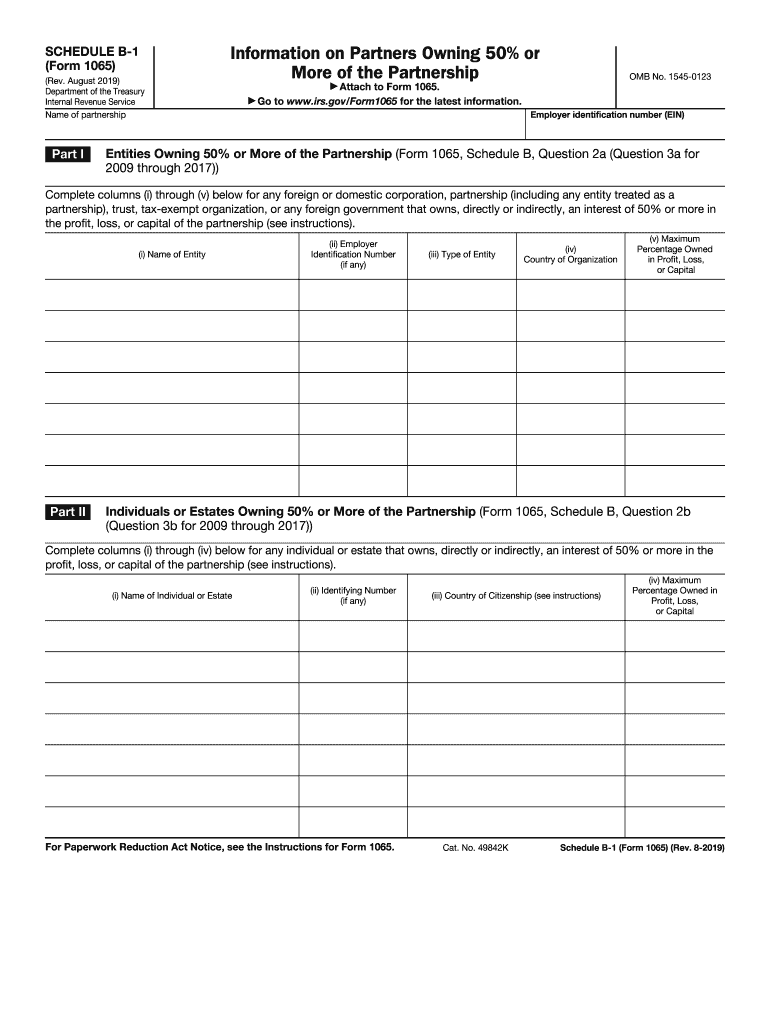

Source: www.signnow.com

Source: www.signnow.com

1065 Schedule B 1 20192024 Form Fill Out and Sign Printable PDF, Due date for form 1065. In addition, for foreign transferors, the information for code ab must also.

Source: printableformsfree.com

Source: printableformsfree.com

2023 Form 1065 Printable Forms Free Online, You have 10 calendar days after the initial date when you transmit a form 1065 electronic return to receive approval on a rejected return. Essentially, form 1065 is an informational form you’ll use to report the business income, gains, losses, income deductions, and credits from your operations.

Source: formswift.com

Source: formswift.com

Form 1065 Partnership Tax Return Fill Out Onlne PDF FormSwift, The form 1041 (estates and trust) deadline to submit. And what information do you need.

Due Date For Form 1065.

Beginning january 1, 2024, partnerships are required to file form 1065 and related forms and schedules electronically if they file 10 or more returns of any type during the tax.

Form 1065 Is Used To Report.

Why is form 1065 important for partnerships?